Lack of financial transparency in the political system has always been one of our key challenges as a democracy. Recently, the government passed a bill in the Lok Sabha that will potentially lead to an increase in anonymous corporate donations to political parties as well as remove previous limits on how much corporations can donate to political parties. Here’s a look at some of the key factors in play.

Status Quo

Currently, political parties in India are exempt from paying income tax but are mandated to file their income tax returns with the IT department. Political parties use various instruments to take in crores of donations every year. These income tax returns have been analyzed by National Election Watch. Here is a snapshot of the amount of income, five of our major national political parties have had over the past decade.

Between 2004-05 and 2014-15, the total incomes of these five major national parties were:

- INC (Indian National Congress): Rs. 3,982 crore

- BJP (Bharatiya Janata Party): Rs. 3,273 crore

- CPM (Communist Party of India-Marxist): Rs. 893 crore

- BSP (Bahujan Samaj Party): Rs. 764 crore

- NCP (Nationalist Congress Party): Rs. 351 crore

From the Rs. 20,000 to the Rs. 2,000 loophole

Until recently the laws allowed political parties to not report donations under Rs. 20,000. This meant that political parties were always receiving “a lot of donations that were individually valued at under Rs. 20,000 each”. Basically, the laws allowed a loophole through which political parties could get away with ‘unknown’ sources of income. In its analysis, National Election Watch also looked at this. Here is what this looks like for five of our major national political parties.

Essentially, for these five national political parties, 71% of all income was from ‘unknown’ sources. There are over 1,000 political parties in India. For some of the regional parties even a larger amount of income comes from ‘unknown’ sources. For instance for this same time period, Samajwadi Party had 94% of its income coming from ‘unknown’ sources and the number was 86% for Shiromani Akali Dal.

Earlier in 2017, Finance Minister, Arun Jaitley suggested reducing this threshold to Rs. 2,000 instead of the current Rs. 20,000. While this is a welcome step and may lead to a few difficulties for political parties, it is not a measure that will worry political parties too much. Historically, political parties have shown that they are very brazen about exploiting every loophole. Since there is no limit on overall donations that can be made , there is a strong possibility that the political parties will treat the Rs. 2,000 limit just the way they treated the Rs. 20,000 limit.

For example, in previous years political parties have used various ‘schemes’ to account for donations. BJP has called its scheme ‘Aajiwan Sahayog Nidhi’ and Congress has sold ‘Coupons’. Both these instruments have allowed people to purchase coupons/make donations, often in denominations of under Rs. 2,000.

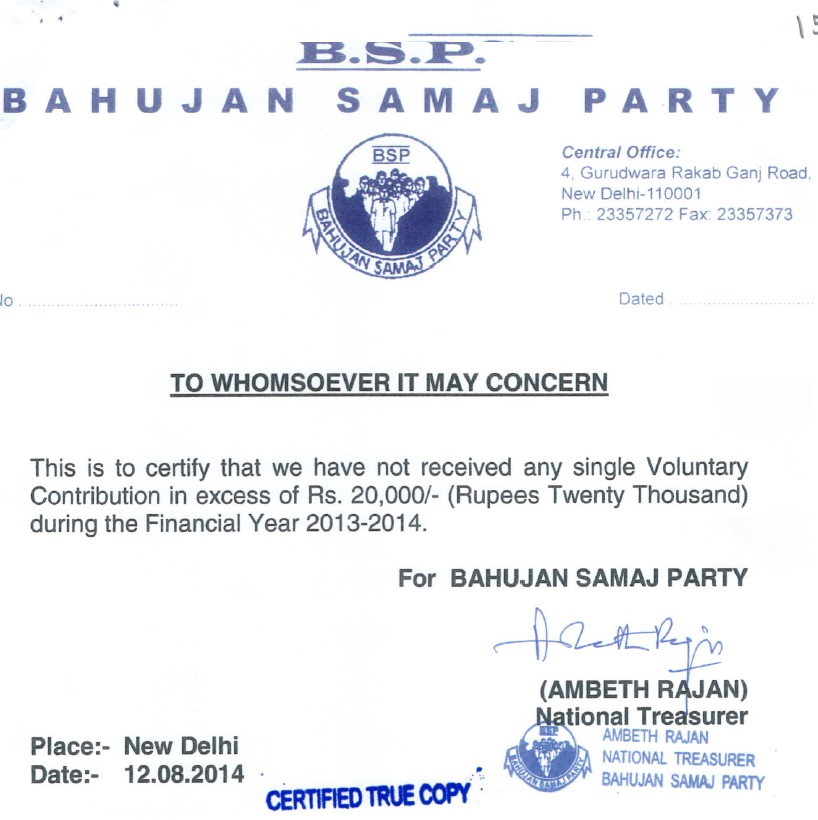

Another example is how BSP has told the Election Commission, almost every year, that it never received a single donation over Rs. 20,000. Here is a screenshot from one of their financial statements. In this year, BSP had a total income of Rs. 67 crores.

Making it easier for corporations to secretly fund political parties

In March 2017, Finance minister, Arun Jaitley, slipped in an amendment to the Companies Act, 2013, in the Finance Bill, 2017, which:

- Removes the cap that barred a company from donating more than 7.5 per cent of its average net profit in the three immediately preceding financial years to a political party.

- Removes a requirement that made it obligatory for a company to disclose in its profit and loss statement the name of the party to which the donation has been made.

The bill was passed by the Lok Sabha after a hurried debate.

As per a report in the Telegraph, a senior official with the Comptroller and Auditor General’s office said “This means, for example, that an infrastructure firm could theoretically pay up to 50 per cent of its net profits to a single party as donation without anyone getting wiser as to which party has been paid… this throws open the possibility that an order to build a highway or a railway bridge could be given to a firm and that firm could pay the donation to the party in power which placed the order with it.The beauty is that if this happens, it will be legitimate and no questions can be asked by any ethics committee of Parliament or by any CAG audit.”

Essentially, it seems that the government is enacting measures to actively reduce transparency by creating legal channels of money exchange between political parties and corporations that keep everyone else out of the loop.

Incidentally, all political parties have resisted the Central Information Commission order to come under RTI. We are used to political parties doing whatever it takes to remain as opaque as they can in their operations, and it seems that this is just the latest chapter in our political parties actively taking decisions that don’t seem to be in the best interests of citizens that they represent.

To read the full National Election Watch report on income analysis of political parties, please click here.

Copyright secured by Digiprove

Copyright secured by Digiprove

1000s of crores Rupees is what our political parties contribute to GDP. LOLZ.

Because who reads the bills? Regaining the perceived lost Hindu pride is more important to the voter.

xprbb

Repeating an old report again n again can not overshadow the fact that Cent Govt has reduced cash donation limit from ₹20000 to ₹2000 n r in discussion with EC to ban completely cash donations to political parties. So u can not say there is no improvement

You are correct – Covered this point in the post. Yes, it is a good step but there is no overall limit on donations. And all pol parties are experts at receiving small donations . e.g. every year BSP has received tens of crores, and they say – kisi ne dus rupay de diye kisi ne bees aur jama karke sau crore ban gaye.

Also, parties have used instruments in the past. BJP has called its scheme ‘Aajiwan Sahayog Nidhi’ and Congress has sold ‘Coupons’. Both these instruments have allowed people to purchase coupons/make donations, often in denominations of under Rs. 2,000. So technically you could have multiple donations of 1900 rupees or multiple coupon purchases of 1000 rupees.

The “bonds” being discussed to remove cash transactions also have allowance for the donor to stay anonymous + The finance bill makes it ok for corporations to not state which party they have donated to .

So why this obsession with anonymity when we actually need more transparency ?

That’s correct but at least a beginning is there

I think this is among the most important information for me. And i’m glad reading your article. But want to remark on few general things, The web site style is wonderful, the articles is really nice : D. Good job, cheers